Companies

Individuals

Projects

About us

Back

Fight the climate crisis with your business.

Get started

For your business

We offer you concrete, high-impact actions to counter the climate crisis. Find the solution that best fits your business goals.

Browse our services

Back

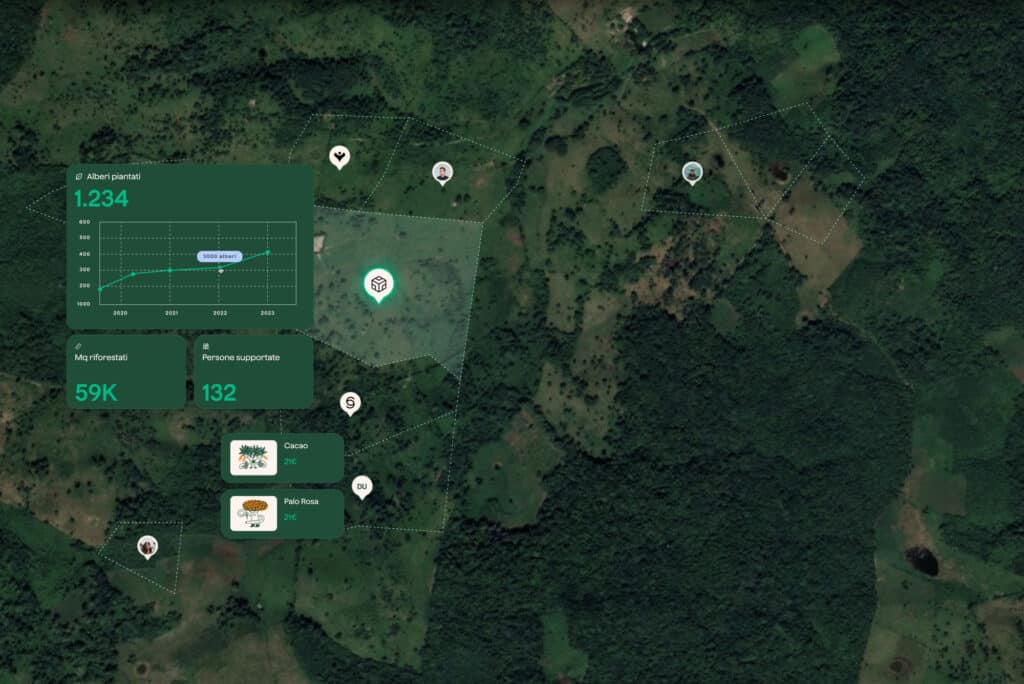

Generate impact, tree after tree.

Get started

Get active for planet Earth.

Countering the climate crisis is the challenge of our century. Become an activist and inspire people around you to act for the future of the planet.

Find out how to do it

Back

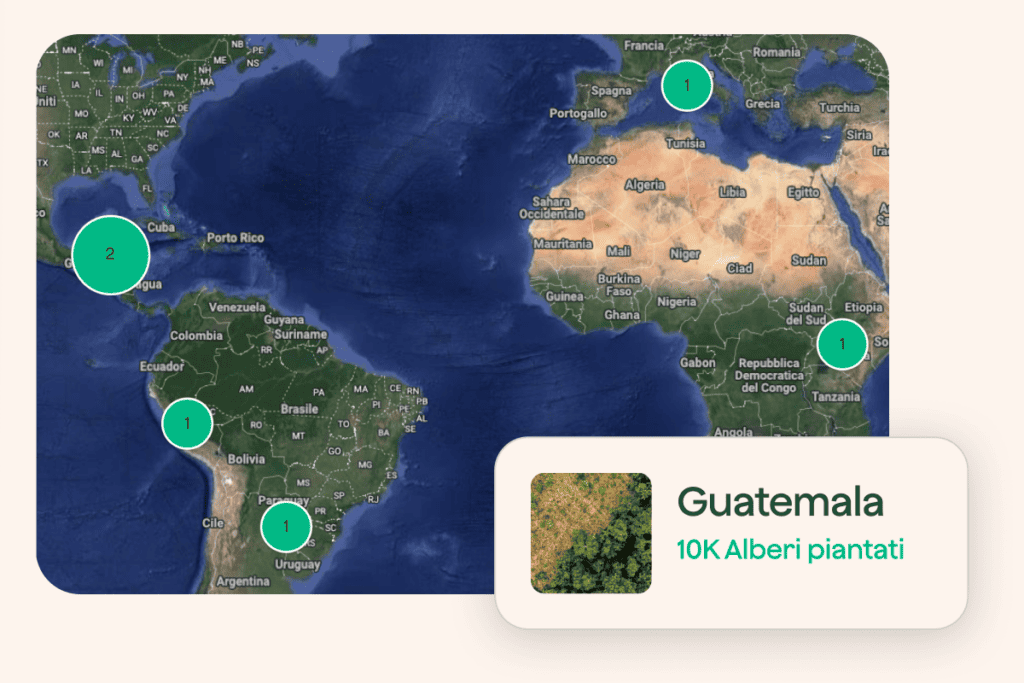

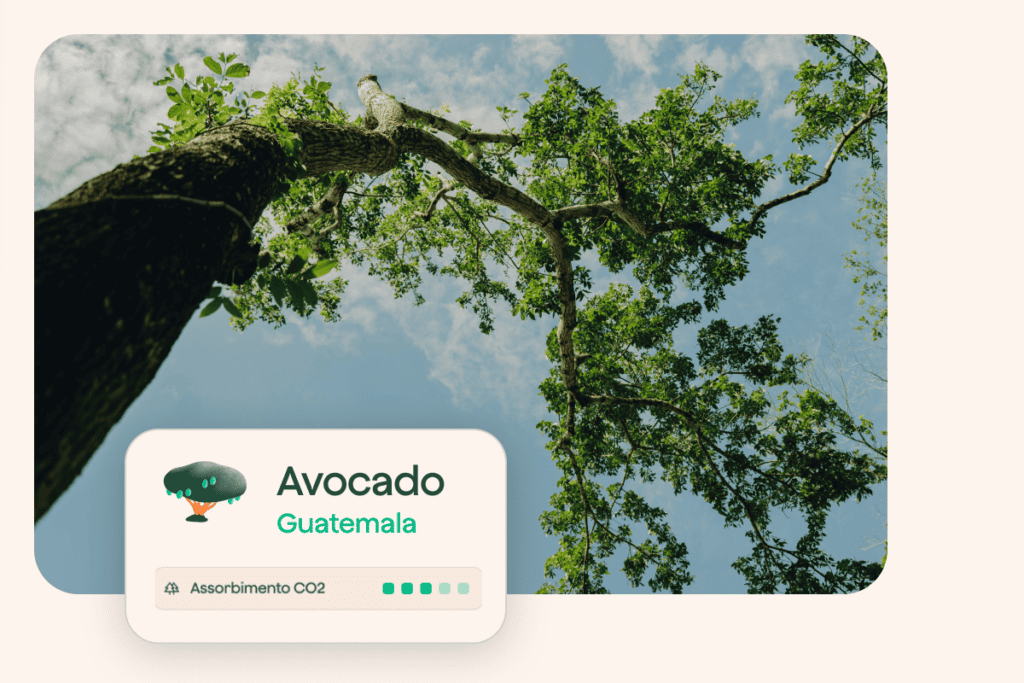

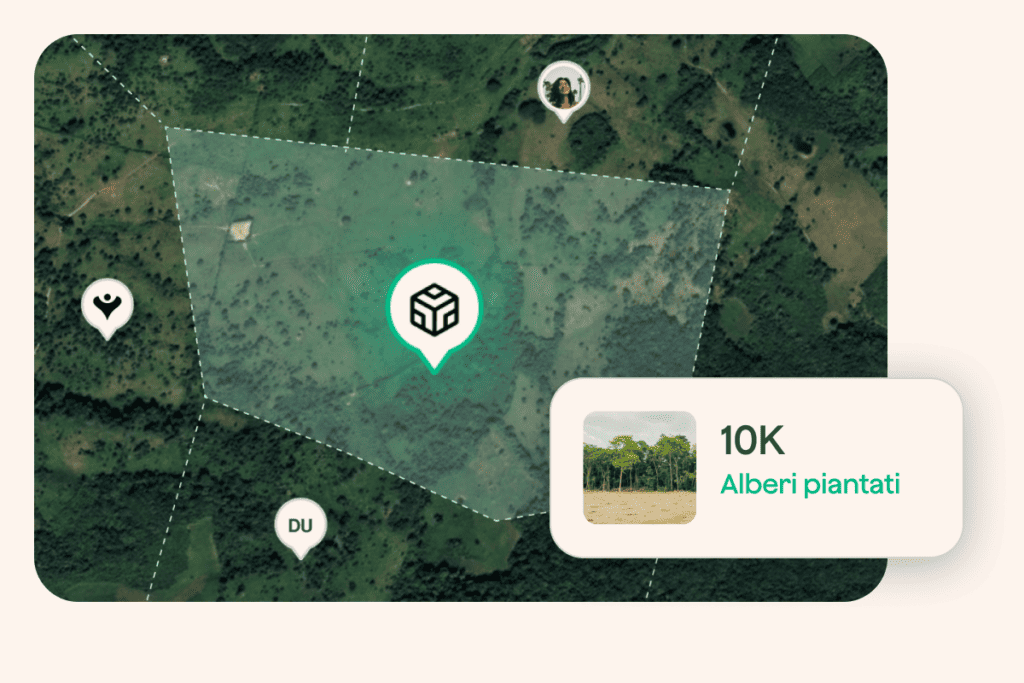

We cultivate resistance all over the world.

Browse our projects

Back

About us

Find out how zeroCO2 was born, discover our milestones and come meet the team.

Read our story

Impact

The goals we want to achieve and those we have already achieved. For people and for the planet.

Discover our impact

Menu

Close