According to Bloomberg,ESG assets will reach $50 trillion by 2050. To understand the magnitude of the figure, one only has to consider that the entire GDP of the Eurozone in 2021 amounted to approximately EUR 14.5 trillion.

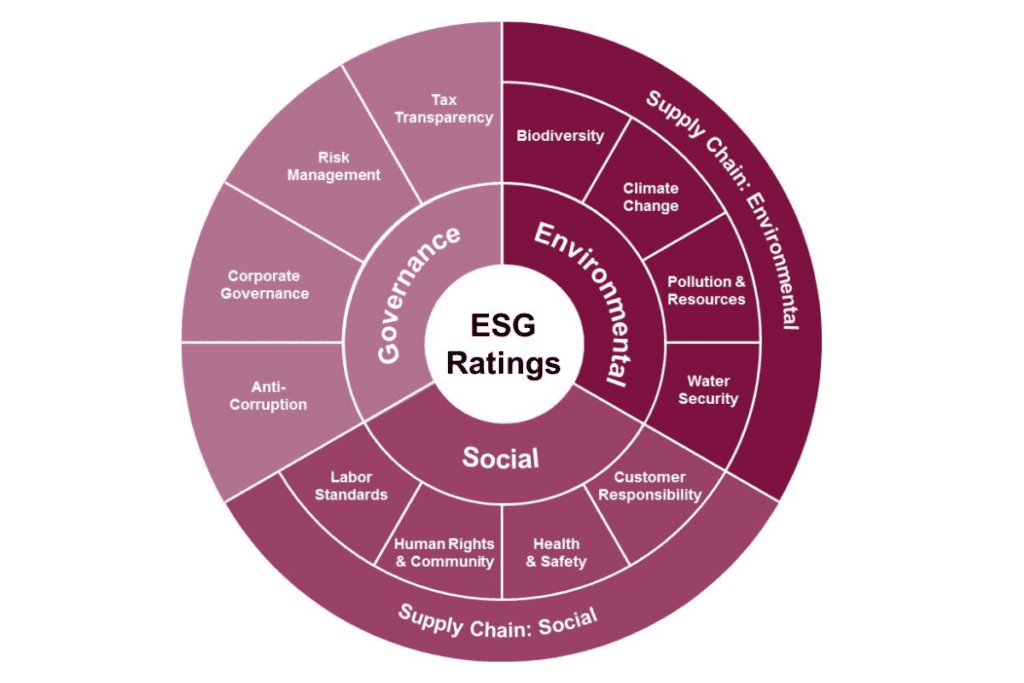

The acronym ESG stands for Environmental, Social, Governance.

An ESG asset is an asset, such as an organisation or a project, whose investment value is primarily determined by its performance concerning the three macro themes mentioned above.

The ESG rating identifies investment opportunities and risks by analysing a company’s data based on a series of indicators (which vary according to the rating agency).

The result is a composite score that takes into account the different ESG factors:

- Environmental score: GHG (greenhouse gas) emissions, waste management, use of renewables, etc.

- Social score: protection of workers’ rights and respect for human rights, support of local communities, occupational safety, social responsibility, inclusiveness, etc.

- Governance score: compliance, enterprise risk management, transparency, etc.

- Materiality also emerges from the analysis, i.e., the relevance and relevance to the company of each of these criteria.

An example?

If the rating concerns an air transport company, among the sustainability objectives, the reduction of CO2 emissions caused by aircraft will be a more material area and, therefore, a priority than, for example, the use of biodegradable packaging for meals provided to passengers.

Is measuring sustainability a strategic action for a company?

Carrying out an ESG analysis and submitting it to a rating system is a time-consuming and labour-intensive process, varying according to size, sector and whether or not there is a sustainability plan integrated into the corporate strategy.

In a few paragraphs, we will answer the question posed above, but we can already say that a company that wants to go green today and, in times of Europe’s New Green Deal and PNRR, wants to access green funds and investments, has in a high ESG rating the key to the future.